Close More Deals Faster

With Lofty, the award-winning, AI-powered platform for real estate professionals.

For Agents

To automate your marketing programs, capture and convert more leads into transactions.

For Teams

To streamline your sales process, maximize collaboration, and close more team deals.

For Brokers

To accelerate profitable growth by boosting agent productivity and lowering operational costs.

The Lofty Platform

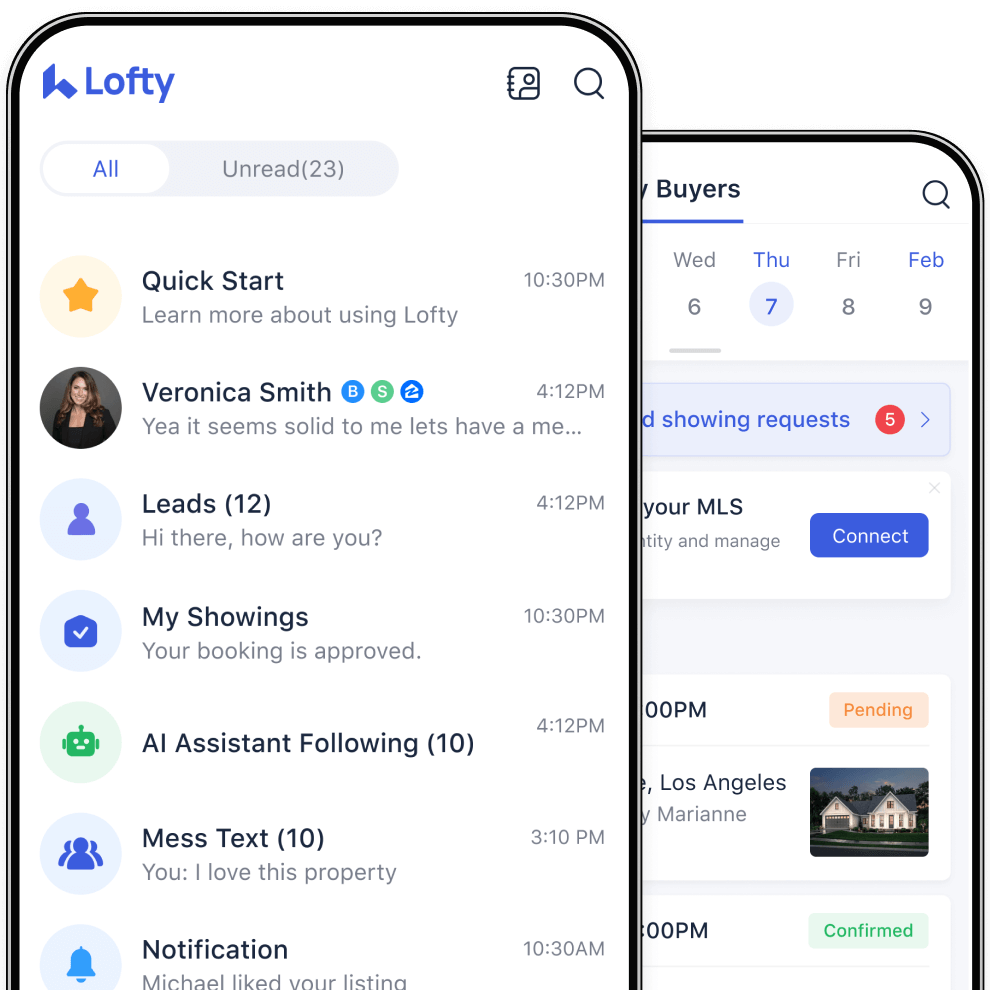

Rated #1 for "Ease-of-Use", Lofty is the all-in-one platform that real estate professionals love! Automate marketing campaigns, boost your brand awareness, capture and convert more leads, all in ONE intuitive platform.

Lofty Features Customers Love

With innovative features like Social Studio, AI Assistant, Dynamic CMA, Video Messaging, and more, Lofty customers have a competitive edge, empowering them to capture and convert more leads into transactions.

Trusted by Top Agents, Teams and Brokers

Lofty Benefits

Lofty customers enjoy time saving automation, cutting-edge mobile apps, flexible contracts, world class customer support, and with new innovative features added every month are confident that they're always one step ahead of the competition.

With Lofty onboard you'll -

Boost productivity

Maximize team collaboration

Increase lead generation

Spend less on tech tools

Save time on marketing

Simplify sales & marketing process

Ready to see Lofty in Action? Book your personalized demo today...

Lofty Success Stories

Ready to Accelerate your Business Growth?

Complete the form to schedule a demo and one of our solution specialists will reach out to confirm your appointment.

We’ll make sure you receive -

- A personalized tour and guidance from one of our top solutions advisors

- Guaranteed lowest price on new subscriptions and add-ons

- Instant access to your new Lofty account upon sign-up

Request a Demo 🎉

.png?width=1200&length=1200&name=Epique-Realty-Logo-NEW-Realty-Black%20(2).png)